Donald Trump’s claim that tariffs bring in $3 billion daily has been debunked by government agencies and financial records, revealing a significant gap in numbers.

Trump claims the US now ains $3 billion a day from tariffs

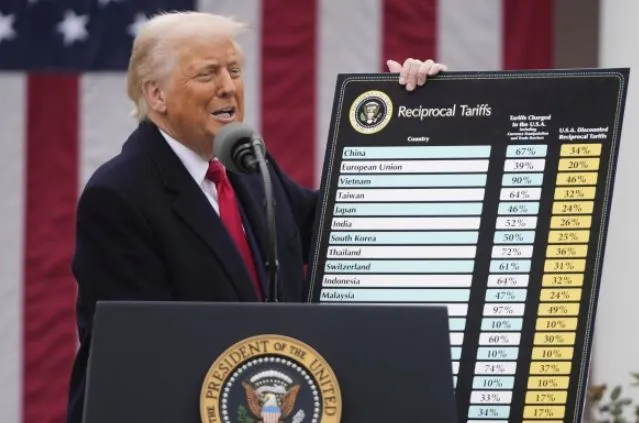

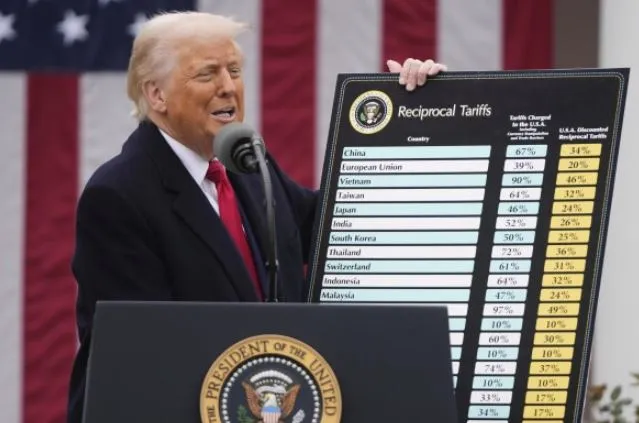

During a meeting with El Salvador’s president on April 14, Trump stated that the US now “makes $3 billion daily” from tariffs on foreign imports.

The president claimed America once “lost $2 billion a day” and credited his administration’s tariff strategy for reversing the trend.

Trump pointed to tariffs on Chinese, Canadian, and European goods as evidence of economic recovery and American strength in the trade war.

Government data contradicts Trump’s tariff revenue statement

Despite Trump’s bold tariff claims, multiple US agencies have released numbers that do not support the $3 billion figure he touted in the Oval Office.

However, New York Post investigation found that the number he mentioned isn’t completely accurate.

Customs and Border Protection (CBP) reported that since April 5, they’ve collected $500 million from reciprocal tariffs—just a fraction of Trump’s daily estimate.

The CBP noted that these figures come from 15 separate trade actions implemented since Trump returned to office on January 20, 2025.

Additionally, treasury records show much lower tariff collection totals.

The Treasury Department’s daily deposit statement showed $305 million in customs and excise taxes on Monday. On the following day, it recorded $250 million.

That brings the average to just $277 million per day.

This figure falls far short of the $3 billion daily revenue Trump claimed in his public remarks.

From January 20 to April 14, total tariff revenue reached about $21 billion — averaging roughly $250 million per day.

“Since April 5, CBP has collected over $500 million under the new reciprocal tariffs, contributing to more than $21 billion in total tariff revenue from 15 presidential trade actions implemented since Jan 20, 2025,” the agency shared.

U.S. inflation drops but stock market reacts to tariff policies

Inflation has slowed to 2.4 percent, the lowest level since September. However, analysts caution that this relief may be short-lived due to ongoing economic and trade tensions.

On Wednesday, the stock market took a hit after new restrictions were announced on semiconductor chip exports to China. These measures further unsettled investor confidence.

Meanwhile, Trump signed a new executive order this week to investigate national security risks tied to U.S. dependence on foreign critical minerals and related products.

Under the latest trade penalties, China now faces tariffs of up to 245%, a move intended to counter Beijing’s aggressive export strategies and technological growth.

China hits back with steep tariff hikes on American goods